How Are I Bonds Taxed? Nine Common Situations

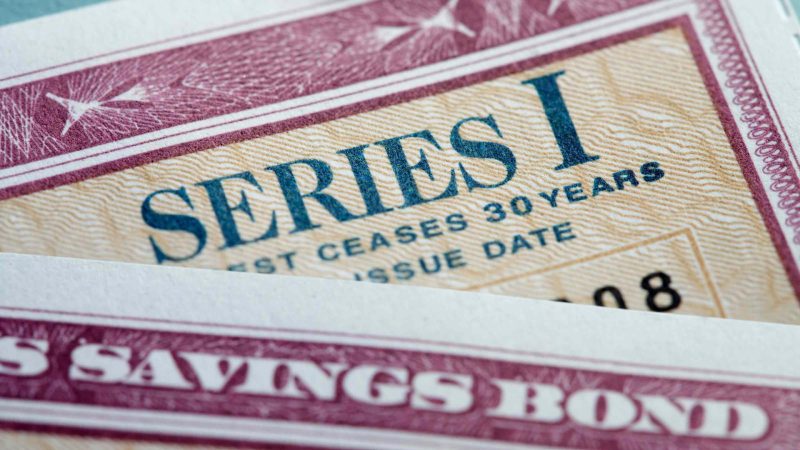

Some investors have owned Series I savings bonds (I bonds) for many years, and the 30-year maturity date is approaching. Others bought Series I savings bonds in recent years to insulate their portfolios from inflation and the ups and downs in the stock market.

Whether you are a recent investor in I bonds, have owned them for many years, or are pondering adding them to your investment portfolio, you should be aware of the federal tax rules.

I bonds have important tax advantages for owners. Interest earned on I bonds is exempt from state and local taxation. Also, owners can defer federal income tax on the accrued interest for up to 30 years.

These rules might seem simple at first. But they can get complicated pretty quickly.

For example, the tax treatment of I bonds varies depending on who owns the bonds, whether you gift the bonds to someone else, and in some cases, how the bonds are used. What follows are descriptions of how and when I bond interest is taxed under federal law in nine common situations. Hopefully, this information will help you trim your tax bill while planning for the future.

Note: For people who own EE bonds, the federal income tax consequences are identical to those of I bonds. So this story is also applicable to you.